CMAI Covid Response

Counselling

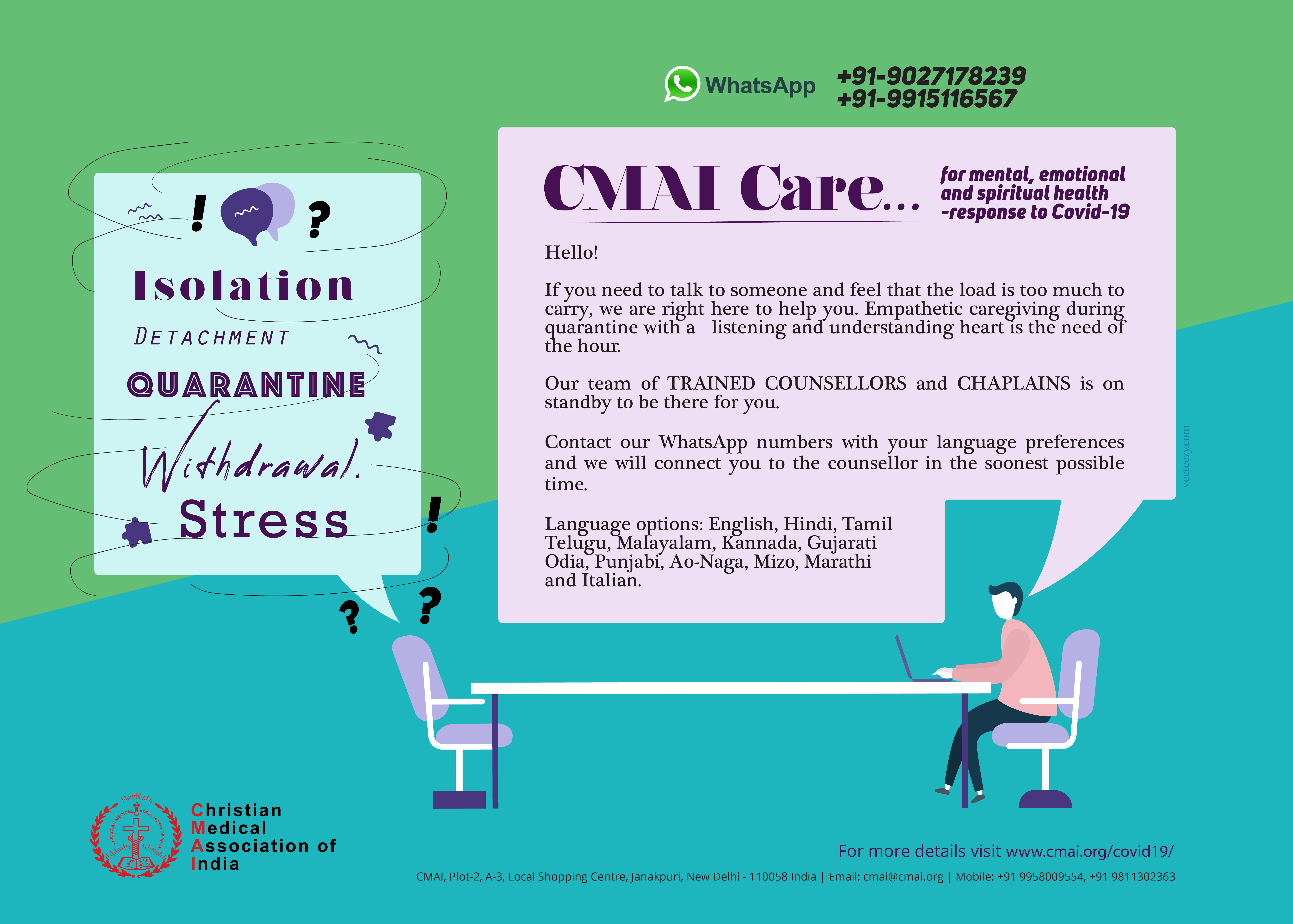

CMAI's Tele-Counselling service in response to Covid-19 Pandemic Care.

Everyone is taking precautions and social distancing ourselves physically during the pandemic to save us. However, very few people are taking precautions to save ourselves mentally, emotionally and spiritually. Apart from calls for social distance there should also be calls for emotional closeness. During quarantine, we need care-ntine for people who feel emotionally distanced. Communication is an important tool and we can use this to listen to each other and involve in empathetic caregiving.

COVID-19 not only affects physical health but also mental well-being. Many are dying alone in hospitals and healthcare facilities cut off from families. COVID-19 virus infected patients tend to go through social and mental stigma. Families of infected people are also affected in unexplainable ways. Deep pain is borne alone as comforting touch, pat on the shoulder and embraces are limited or zeroed down with ‘no touch’ protocol due to the pandemic. The numbers of infected people are increasing but more than numbers; they are mothers, fathers, spouses, children, friends, colleagues or loved one for somebody.

Understanding the need, CMAI would like to offer tele-counselling services in such times to do the smallest acts we can to help people. If anyone feels the need to talk to someone and feel that the load is too much to carry, we are here to help you with a listening heart. We have chaplains and counsellors from across the country who will be available to help, to care for you emotionally, mentally and spiritually.

Contact us to our WhatsApp numbers +91-9027178239 and +91-9915116567 with your language preference and we will connect you to the counsellor the soonest possible time.

The caregivers can speak in the following languages:

- English

- Hindi

- Tamil

- Telugu

- Malayalam

- Kannada

- Gujarati

- Odia

- Punjabi

- Ao-Naga

- Marathi

- Mizo

- Italian

Your contributions to CMAI are eligible for tax exemption under section 80G of Income Tax Act

Head Quarters

CMAI

A-3, Local Shopping Centre, Janakpuri,

New Delhi - 110058, India

011-41003490 / 41064328

+91-11-255 98 150

cmai@cmai.org

Bangalore Office

HVS Court, 3rd Floor

21 Cunningham Road

Bangalore – 560052,

Karnataka

080 22205464, 22205837, 22257844

080 22205826

cmaiblr@cmai.org

Registered Office

CMAI

Christian Council Campus

NCCI Road, Civil Lines

Nagpur – 440001

Maharashtra